Bad Credit Car Loan

Buying a new car with bad credit: Possibilities and considerations

Buying a new car with bad credit: Possibilities and considerationsAre you wondering if it's possible to purchase a new car with bad credit? While having bad credit may present some challenges, it doesn't necessarily mean you can't buy a new car. In this article, we'll explore the possibilities and considerations when it comes to buying a new car with bad credit.

1. Specialized Financing Options:

Many dealerships and lenders offer specialized financing options for individuals with bad credit. These programs are designed to help people with less-than- perfect credit histories secure auto loans. By working with these specialized lenders, you increase your chances of obtaining financing for a new car.

Read more

Leveraging new car rebates and incentives for bad credit buyers introduction

Leveraging new car rebates and incentives for bad credit buyers introduction

If you have bad credit and are considering purchasing a new car, you may wonder if new car rebates and incentives can work in your favor. In this article, we will explore how new car rebates and incentives can benefit individuals with bad credit, providing an opportunity to secure a new vehicle despite credit challenges.

1. Reduced Purchase Price:

New car rebates and incentives often result in a reduced purchase price, which can be advantageous for buyers with bad credit. A lower purchase price means a lower loan amount, potentially increasing the likelihood of loan approval and more affordable monthly payments.

Read more

Will a new or used car be more practical for a person with bad credit to buy?

Will a new or used car be more practical for a person with bad credit to buy?When considering whether to purchase a new or used car with bad credit, several factors come into play. While each person's situation is unique, let's explore the practicality of both options to help you make an informed decision.

1. Affordability:

Generally, used cars are more affordable than new cars. If you have bad credit, it's important to consider your budget and monthly payment capabilities. Used cars often have lower purchase prices, which can make them more accessible to individuals with limited financial resources.

2. Lower Depreciation:

New cars typically experience significant depreciation in their early years of ownership. This depreciation can result in a higher loan-to-value ratio, which may be less favorable for ...

Read more

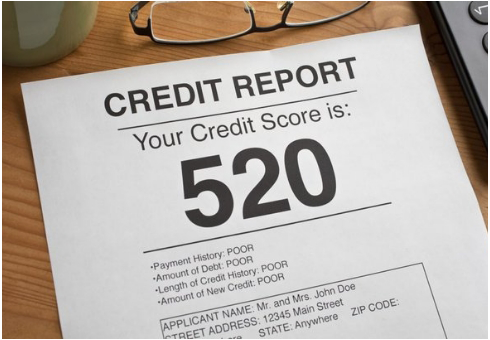

Getting a car loan with a 500 credit score: Yes, with the right dealership and affordable options

Getting a car loan with a 500 credit score: Yes, with the right dealership and affordable optionsA credit score of 500 may be considered low, but it doesn't necessarily mean you can't get a car loan. By working with the right kind of dealership, such as those available through EasyDrive.com's network, and selecting affordable car options, you can still secure a car loan despite your credit challenges. In this article, we will explore how it is possible to obtain a car loan with a 500 credit score by partnering with understanding dealerships and making sensible choices.

1. Specialized Dealerships:

Dealerships within EasyDrive.com's network specialize in assisting individuals with less-than-perfect credit histories. These dealerships understand ...

Read more

The value of GAP Insurance for new or used cars with bad credit

The value of GAP Insurance for new or used cars with bad creditWhen financing a new or used car, it's important to consider protecting your investment. One valuable form of protection is Guaranteed Asset Protection (GAP) insurance. This article will explore the value and benefits of obtaining GAP insurance, particularly for individuals with bad credit.

1. Understanding GAP Insurance:

GAP insurance is designed to bridge the "gap" between the actual cash value of your vehicle and the remaining loan balance in the event of a total loss or theft. It covers the difference between what your insurance company pays out and what you still owe on your car loan.

Read more

Securing an extended warranty with bad credit: Protecting your investment

Securing an extended warranty with bad credit: Protecting your investmentWhen purchasing a new or used car, having an extended warranty can provide peace of mind and protect you from unexpected repair costs. Many people wonder if it's possible to obtain an extended warranty with bad credit. In this article, we will explore how you can secure an extended warranty, regardless of your credit situation.

1. Importance of Extended Warranties:

An extended warranty is a service contract that covers the repair costs of your vehicle after the manufacturer's warranty expires. It provides financial protection against costly repairs, offering peace of mind and ensuring that you won't face unexpected expenses.

Read more